Partner with a Team of Passionate

Small Business Champions

15,000

jobs created and preserved

$2 Billion

in loans, empowering growth and opportunity

2,000

businesses with dedication and care

Faith-Based

SBA lender, driven by purpose and faith

Trusted by Many

AmPac Business Capital is a mission-driven lender dedicated to advancing entrepreneurial dreams through access to capital and resources that foster long-term business success. AmPac provides tailored financing solutions and support through its Community Lending Programs, SBA 504 loans, and Entrepreneur Ecosystem—guiding businesses from cradle to legacy.

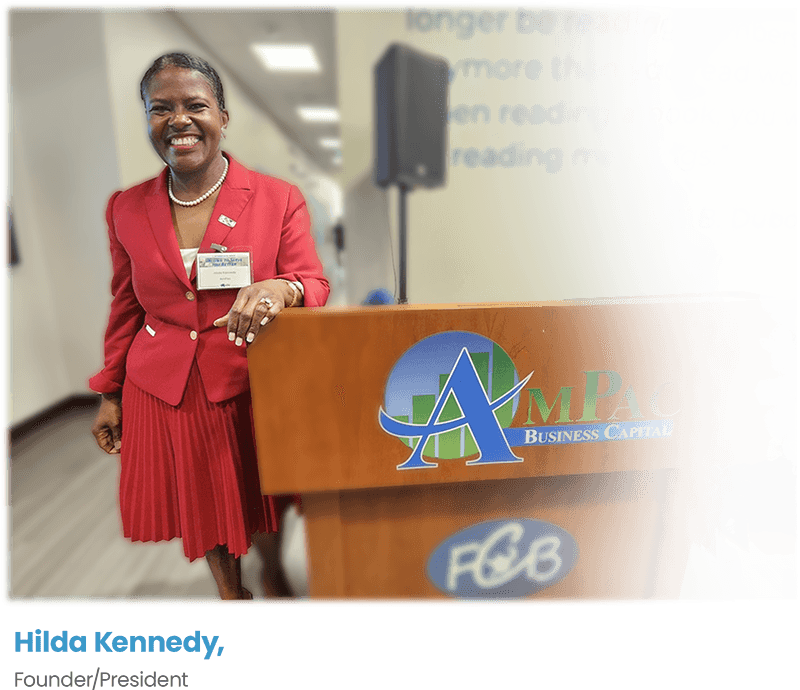

Founded by Hilda Kennedy in 2005, AmPac is a private nonprofit organization headquartered in Ontario, California. As the first faith-based SBA 504 lender in the nation, AmPac was built to serve small business owners who are often overlooked by traditional lenders. Through a commitment to economic empowerment and inclusive opportunity, AmPac continues to help entrepreneurs build stronger businesses and stronger communities.

Financing Options For Entrepreneurs

SBA 504 Loans

SBA 504 Loans

With down payments as low as 10% for commercial real estate, SBA 504 loans are one of the best funding options for small businesses!

Community Lending Small Business Programs

Community Lending Small Business Programs

Built to serve small businesses at all stages, these programs fund working capital, equipment, expansion, and more, with personalized support and a mission to close the gap to growth!

Entrepreneur Ecosystem

Entrepreneur Ecosystem

Wherever you are in your small business journey, AmPac will support you in advancing your entrepreneurial dream.

Transforming Communities, Strengthening Families, & Inspiring Entrepreneurial Success

Your Vision, Our Mission

Your goals are within reach—start with the right funding options.

Own the

Space That Powers Your Business

Ready to own your own building? AmPac will help you secure your commercial property and invest in your future.

Invest

in New Equipment

Find out how financing for machinery and equipment can give your business the tools it needs to succeed.

Refinance Your Commercial Debt

Discover how AmPac can refinance your commercial debt and help you achieve your business goals.

Make Your Property Shine

Financing for tenant improvements and ground-up construction, helping businesses build or customize spaces to fit their needs.

Working Capital Under $100,000

Flexible financing for working capital, helping businesses cover day-to-day expenses and propel growth.

At The Heart Of Everything,

We Keep It Simple.

Three steps to put your business first so you can focus on your path to success, while we ensure financial hurdles don’t slow you down.

Explore Our

Entrepreneurship Ecosystem

Get plugged in to our Entrepreneurial Support Hub

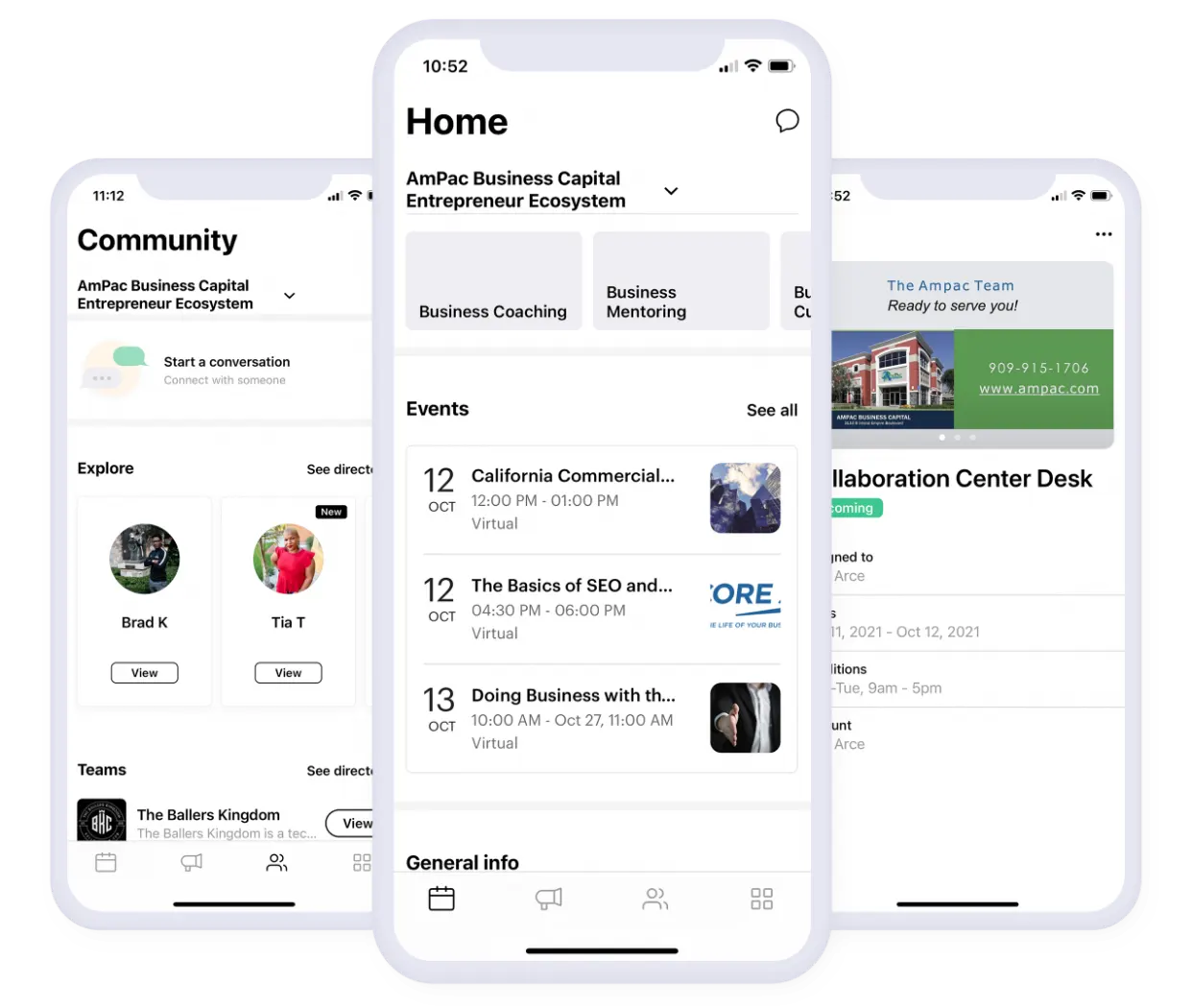

The Entrepreneur Ecosystem provides access to powerful resources, tailored guidance, and a thriving community. It supports business growth through hands-on coaching and personalized technical assistance, provides co-working spaces, connects entrepreneurs with industry experts, while also hosting networking and training events designed to foster collaboration and create new opportunities.

Perks of Being a Mobile App Member

Message And Share Updates With

Over 2,500 Business Professionals

for in-person work

e-learning, and loan application support

accelerate your business journey

Powerful Partnerships, Meaningful Impact

Rooted in Shared Values

You can always count on us, walking beside you on your business journey.

Our commitment is to nurture small businesses on the path to success. With the support of our trusted partners, we provide the capital and resources you need, no matter where you are in your entrepreneurial journey.