AmPac Helps Small Businesses During Pandemic

COVID-19 has sent the small business community and the economy into a tailspin. For many, it’s a matter of getting creative and securing loans to survive the effects of the pandemic and stay in business.

AmPac Business Capital has been a beacon of light for business owners in Southern California’s Inland Empire, providing small businesses—including businesses in underserved communities–with the capital they need to sustain during COVID-19 and to grow their businesses.

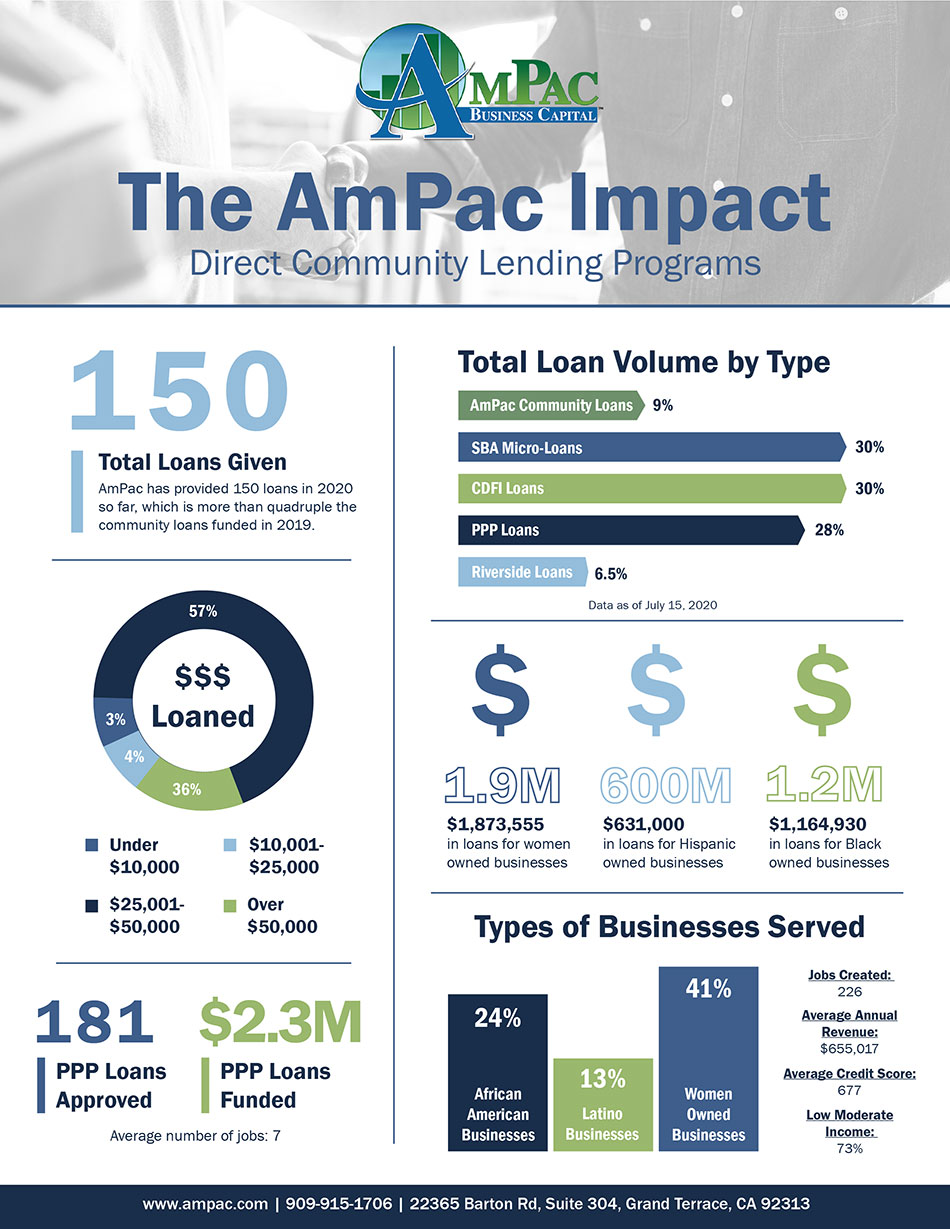

In just 90 days, AmPac has funded more than $2.3 Million in PPP and Riverside County COVID-19 relief loans for over 140 small businesses.

One client, Jose Duenas, the owner of El Atacor Restaurant located in Los Angeles said, “Prior to the PPP approval I was extremely fearful that I would lose my business because I did not have the funds to bring back my employees,” said Duenas. “By receiving this loan, my confidence was instantly regained and I became hopeful again.” Read how AmPac Business Capital helped Jose with his business.

Impressed by AmPac’s commitment to supporting small businesses with a variety of loan programs, Pacific Western Bank has chosen to give AmPac a $500,000 investment to fund loans designated to support small business expansion in the Inland Empire region and the eastern border of Los Angeles County, including the city of Pomona.

This investment is right on time. According to a recent survey from the National Federation of Independent Business, most firms have already run out of the money they secured from the $600 billion Paycheck Protection Program.

With the investment from Pacific Western Bank, AmPac is expanding its CDFI small business loan program. Businesses that have been established at least two years may apply for loans up to $50,000 for general working capital, including inventory, equipment, personnel costs, and related expenses.

“We are excited to receive this generous investment from Pacific Western Bank. It will go a long way to help us to continue the work we have done for many years, serving small businesses and targeting underserved communities, including women and minority owned businesses,” said Hilda Kennedy, Founder and President of AmPac Business Capital.

Focusing on Underserved Communities

There are 1.1 Million minority-ownedsmall businesses with employees in America. These firms are an important job source, employing more than 8.7 million workers.

According to data from the Small Business Credit Survey, large banks approve about 60% of loans by white small business owners, 50% of loans sought by Latino small business owners and just 29% of loans sought by Black small business owners.

AmPac Business Capital, as a direct community lender, is dedicated to assisting the underserved. Of the loans funded through 2019, 41% went to women; 24% to African American; and 13% to Latino business owners. Seventy-three percent of the loans went to Low- and Moderate-Income (LMI) borrowers.

“PWB is proud to invest in the communities where it conducts business and it understands that contributing to the economic vitality of its communities has a positive and measurable effect on the growth and prosperity of those communities and more importantly – makes good business sense!” Pacific Western Bank said in a statement.

Stay up to date with AmPac News

Are you ready to finance growth?

Click apply now, setup and account, and get access to applications and assistance.